Chapter 13 Bankruptcy Lawyer Tulsa Things To Know Before You Buy

You can keep your home or vehicle as long as you're current on the repayments, can continue making settlements after the personal bankruptcy situation, and can exempt the amount of equity you have in the property. Learn what happens to vehicles in Chapter 7 bankruptcy. Chapter 7 works quite possibly for many individuals, particularly those who own little home, have predominately debt card equilibriums, clinical costs, personal fundings, and various other debts that get wiped out in personal bankruptcy.

Her state's mean earnings for a bachelor is $65,000, so Helen will not pass the first part of the Chapter 7 indicates test. Helen will certainly deduct actual and allowed expenses in the second portion of the ways examination and pass if the estimation demonstrates that she doesn't have extra funds to pay financial institutions.

Which Type Of Bankruptcy Should You File Can Be Fun For Everyone

If you declared Phase 7, your financial institution can quickly accumulate the whole balance owed when the personal bankruptcy instance nearby garnishing your wages, levying your savings account, and even seizing property - Tulsa OK bankruptcy attorney. Instead, you can make use of the Chapter 13 strategy to pay these financial obligations off over three to five years without the hazard of extreme collection activities hanging over your head

By contrast, if you file for Phase 13 insolvency, the creditor will leave your codebtor alone if you stay on par with your bankruptcy plan repayments and pay the financial debt in full. Find out more about what occurs to codebtors in bankruptcy. When you declare Phase 7 insolvency, you can maintain property safeguarded or "excluded" from financial institutions under state or federal legislation.

In Chapter 13 personal bankruptcy, you do not have to give up any type of building. If you have nonexempt residential property you can not birth to part with and can manage to pay to maintain it, Chapter 13 bankruptcy could be the much better option.

Experienced Bankruptcy Lawyer Tulsa Things To Know Before You Buy

A cramdown reduces the quantity you owe to the security's actual worth, so it functions wonderful when you owe greater than the residential or commercial property deserves. Yet below are the catches. A cramdown doesn't put on the home you stay in, and you need to pay the entire reduced equilibrium through the settlement strategy.

If you marketed the house, the sales earnings would not completely pay the initial home mortgage, so there 'd be absolutely nothing to pay towards the second.

If you marketed the house, the sales earnings would not completely pay the initial home mortgage, so there 'd be absolutely nothing to pay towards the second.The smart Trick of Bankruptcy Law Firm Tulsa Ok That Nobody is Talking About

In Phase 13 bankruptcy, you have to pay your lenders every one of your disposable incomethe quantity staying after enabled regular monthly expensesfor 3 to 5 years. Disposable earnings is the amount that stays after deducting permitted personal bankruptcy expenses from your regular monthly gross earnings. When you declare your deductions, you can use the actual expense of some costs and the nationwide and neighborhood standards for others, such as the allocation for food, clothing, and real estate.

Otherwise, you will not qualify.

Listed below, you'll find more write-ups clarifying how insolvency functions. We wholeheartedly motivate study and understanding, yet online posts can not address all personal bankruptcy issues or the truths of your situation.

The Best Strategy To Use For Bankruptcy Attorney Near Me Tulsa

If your income surpasses that quantity, a means examination is required to establish Phase 7 qualification. The test compares your household income and expenses to average worths for your area. If the test finds economic methods that exceed a lawful threshold, your Phase 7 filing is stated to have an assumption of misuse.

You can get Chapter 13 insolvency if you have routine revenue and your total secured and unprotected financial debts are much less than $2,750,000 (the limit for 2024) on the date you apply for bankruptcy. No. Neither Phase 7 nor Chapter 13 demands settlement of all arrearages. In Phase 7, if you have possessions of worth over of the quantity excluded by state Tulsa bankruptcy attorney and federal regulation, they are offered and the profits are dispersed to your creditors.

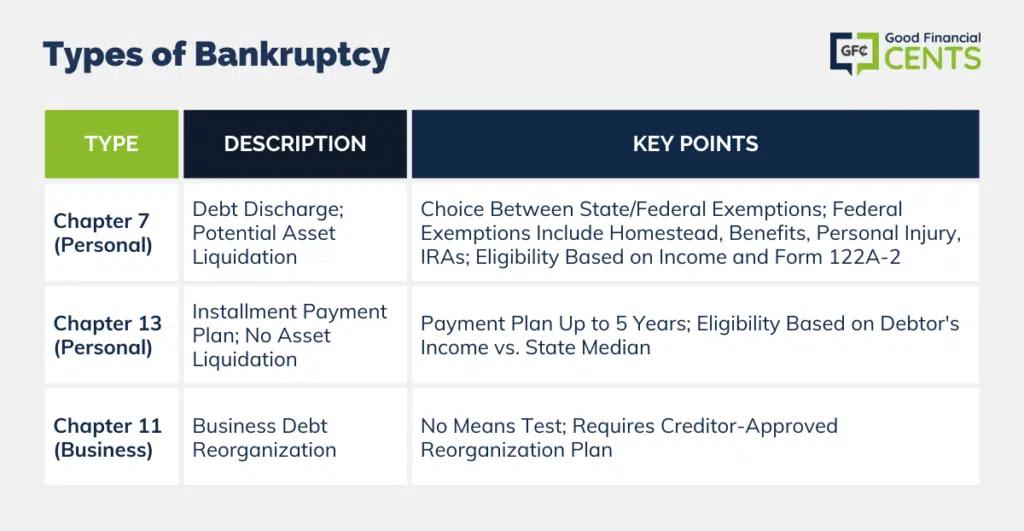

You can get Chapter 13 insolvency if you have routine revenue and your total secured and unprotected financial debts are much less than $2,750,000 (the limit for 2024) on the date you apply for bankruptcy. No. Neither Phase 7 nor Chapter 13 demands settlement of all arrearages. In Phase 7, if you have possessions of worth over of the quantity excluded by state Tulsa bankruptcy attorney and federal regulation, they are offered and the profits are dispersed to your creditors.Because personal bankruptcy influences firms really differently than individuals, little organization proprietors will certainly additionally desire to find out about small company bankruptcy approach. Considering the highlights of Phases 7 and Chapter 13 is an excellent way to find out about bankruptcy differences.: A Phase 7 bankruptcy discharges most kinds of unsecured financial obligation.

The Ultimate Guide To Tulsa Bankruptcy Legal Services

: Lots of Chapter 7 borrowers keep all or most of their building using insolvency exceptions. Petitioners with nonexempt building can shed it to satisfy some debts. Businesses aren't qualified to maintain residential property using exemptions.: The trustee doesn't offer property in Phase 13 personal bankruptcy. You pay lenders the value of the nonexempt home you can not protect with a personal bankruptcy exception via the payment strategy.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more